How to Save Money on Your Home Loan with a Mortgage Broker San Francisco

How to Save Money on Your Home Loan with a Mortgage Broker San Francisco

Blog Article

Just How a Home Mortgage Broker Can Aid You in Browsing the Home Mortgage Process

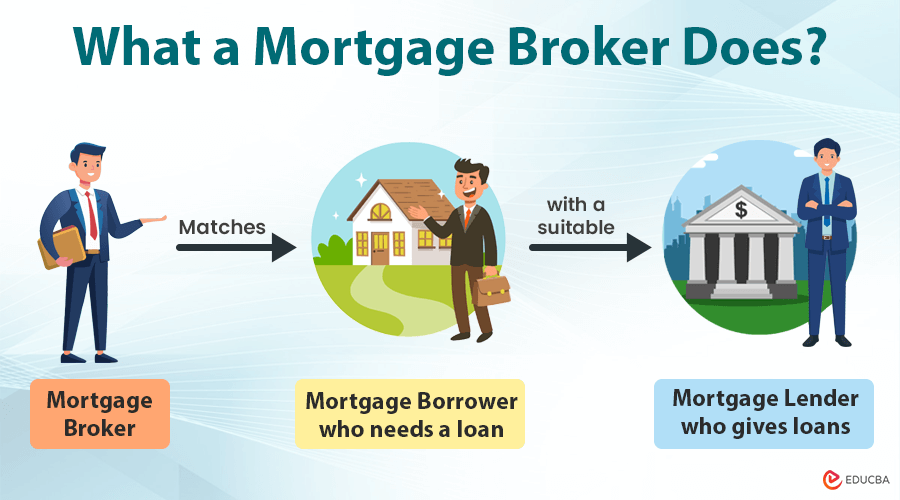

Navigating the intricacies of the home finance procedure can be intimidating for numerous potential purchasers. A home mortgage broker serves as an important resource, leveraging their proficiency to evaluate your financial situation, attach you with different loan providers, and simplify the application procedure.

Comprehending the Role of a Home Mortgage Broker

A home loan broker serves as an essential intermediary between lending institutions and consumers, promoting the lending procedure for individuals looking for financing to acquire or refinance a home - mortgage broker san Francisco. They possess considerable understanding of the mortgage market and have accessibility to a large range of funding items from numerous loan provider. This allows them to determine the most suitable alternatives tailored to a customer's one-of-a-kind monetary circumstances

Home mortgage brokers streamline the application process by collecting required paperwork, assessing creditworthiness, and sending applications in behalf of the customer. They function as supporters, negotiating problems and terms to safeguard favorable rate of interest and lending terms. Furthermore, they aid consumers navigate the complexities of mortgage jargon and legal demands, making certain that customers fully understand their choices before making a dedication.

Assessing Your Financial Circumstance

Prior to starting the home loan trip, a comprehensive assessment of your monetary scenario is essential. This assessment serves as the structure for understanding your loaning capacity and establishing ideal funding options. Begin by examining your income sources, consisting of income, incentives, and any type of additional revenues, to develop a clear image of your monetary stability.

This will certainly assist identify your non reusable revenue, which is important for reviewing exactly how much you can allocate towards a mortgage settlement. Furthermore, it is vital to analyze your credit score, as this will considerably influence your finance qualification and rate of interest prices.

Additionally, assess your cost savings to determine the amount available for a deposit and linked closing prices. A solid economic cushion not just enhances your borrowing capacity yet also offers safety and security during the home acquiring process. By performing this detailed assessment, you will obtain useful understandings that equip you to browse the home loan landscape with self-confidence, ensuring an educated choice when involving with a home mortgage broker.

Accessing a Large Range of Lenders

Accessing a variety of loan providers is just one of the crucial benefits of working with a home loan broker. Unlike private consumers that may be limited to their bank's offerings, home mortgage brokers have established partnerships with a diverse selection of lenders, including banks, credit history unions, and personal loan providers. This wide access enables brokers to resource a selection of loan products customized to various financial circumstances and customer needs.

A mortgage broker can provide choices from multiple lenders, each with unique terms, rate of interest, and problems. This affordable landscape not only empowers customers to locate one of the most desirable mortgage terms yet also encourages lenders to provide extra appealing prices to safeguard organization. Additionally, brokers can determine specific niche lenders that might concentrate on details loan kinds, such as those for novice property buyers or people with less-than-perfect credit scores.

Simplifying the Application Process

Navigating the home loan application procedure can frequently feel frustrating for several customers, however a mortgage broker plays an essential role in simplifying this experience. They work as a bridge between the borrowing and the borrower organizations, leading clients with each action of the application.

A mortgage broker starts by analyzing the economic circumstance of the my sources consumer, aiding to gather required documentation such as earnings verification, credit scores records, and work background. By arranging these records and ensuring they meet loan provider demands, brokers conserve consumers considerable time and stress. This preparation is essential, as incorrect or incomplete applications browse around this site can result in delays or straight-out beings rejected.

This proactive technique not just streamlines the application yet additionally boosts the overall effectiveness of securing a home loan. Inevitably, a home mortgage broker's knowledge and assistance can transform a difficult procedure right into an extra convenient and straightforward experience for potential house owners.

Working Out Much Better Prices and terms

A mortgage broker acts as an effective advocate for consumers when it comes to bargaining better terms and rates on their mortgage. With extensive understanding of the lending landscape, brokers take advantage of their relationships with different lenders to aid customers safeguard beneficial problems that straighten with their monetary goals.

Among the key benefits of collaborating with a home mortgage broker is their capacity to accessibility numerous finance products and rate of interest. This accessibility makes it possible for brokers to contrast deals and recognize one of the most affordable options available to their clients. They use strategic negotiation strategies, usually causing lower rate of interest and lowered costs, which can cause significant financial savings over the life of the loan.

Furthermore, a home loan broker can analyze a borrower's distinct monetary situation and suggest customized services that show their demands. This customized technique enables brokers to support efficiently on part of their customers, guaranteeing that they receive the most effective possible terms.

Ultimately, partnering with a home loan broker can substantially improve a consumer's capacity to protect helpful home mortgage terms, helping with a smoother and extra economical home funding experience.

Verdict

A mortgage broker serves as an important intermediary in between customers and lending institutions, assisting in the lending process for people looking for funding to re-finance a home or acquire.Home mortgage brokers streamline the application process by collecting necessary documents, analyzing creditworthiness, and sending applications on behalf of the customer. By conducting this comprehensive assessment, you will get valuable insights that empower you to navigate the home mortgage landscape with self-confidence, making certain a knowledgeable choice when engaging with a mortgage click site broker.

One of the essential advantages of working with a home mortgage broker is their capacity to access multiple loan products and passion prices.In final thought, the knowledge of a mortgage broker plays an essential duty in browsing the complexities of the home finance procedure.

Report this page